Trying to understand this but the wife is in the ear tonight & i can't wrap my head around it all.

Basically we'll be looking at fixed term for sure, and probably for 5 years. There are so many options though & i don't really understand the difference between them tbh.

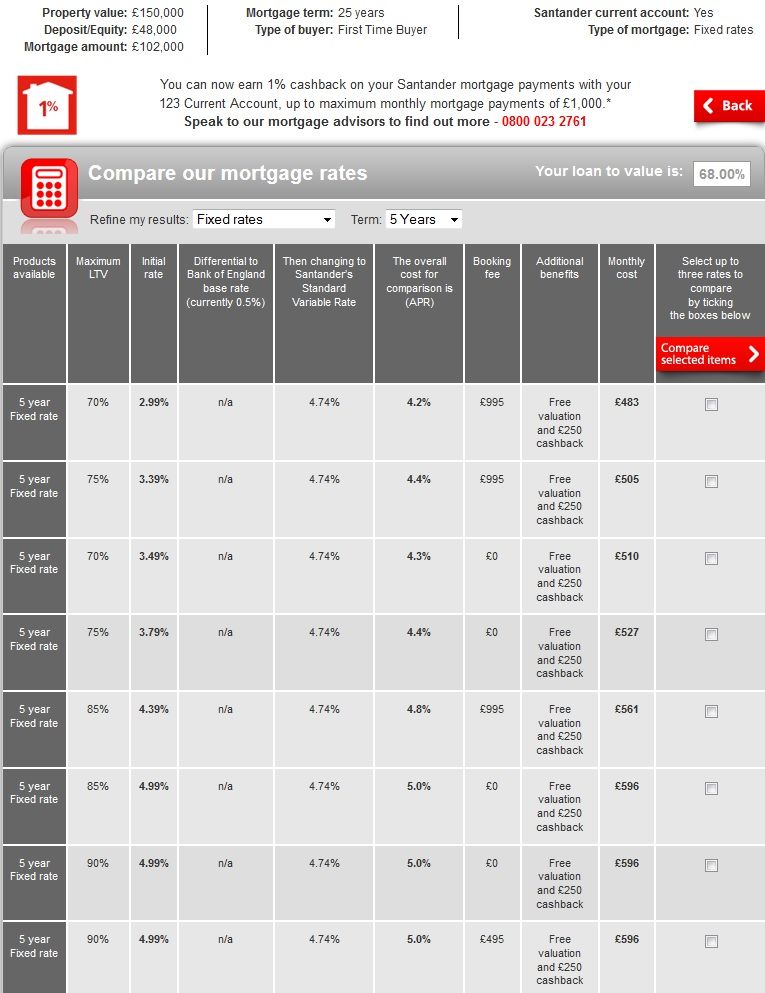

Not sure if photobucket is going to be annoying & resize my screencap so small, but here goes...

![]()

There's 8 different options. As we're just stepping into this, it boggles my mind.

What i do understand however is the final column - the monthly fee. Is this the only one that really matters? As if so, then i'd obviously be opting for the top one as it's cheapest.

EDIT: I was reading a book today on buying your first house by that Phil Spencer (is it?) bloke.

Do you only see your bank/BS for your mortgage? There's nobody else you'd bother to see? (so we're talking Nationwide, Santander, FD, Halifax etc etc etc, but only those?) If the answer is yes, do you have to be an account holder with them, or does it help to be an account holder with them?

Basically we'll be looking at fixed term for sure, and probably for 5 years. There are so many options though & i don't really understand the difference between them tbh.

Not sure if photobucket is going to be annoying & resize my screencap so small, but here goes...

There's 8 different options. As we're just stepping into this, it boggles my mind.

What i do understand however is the final column - the monthly fee. Is this the only one that really matters? As if so, then i'd obviously be opting for the top one as it's cheapest.

EDIT: I was reading a book today on buying your first house by that Phil Spencer (is it?) bloke.

Do you only see your bank/BS for your mortgage? There's nobody else you'd bother to see? (so we're talking Nationwide, Santander, FD, Halifax etc etc etc, but only those?) If the answer is yes, do you have to be an account holder with them, or does it help to be an account holder with them?